The global gaming industry has entered its golden decade—an entertainment juggernaut valued at more than $200 billion, eclipsing film and music combined. From hypercasual mobile hits to immersive AAA blockbusters, games are no longer fringe leisure but a mainstream cultural force shaping how people interact, learn, and spend. Emerging markets have become especially critical: Turkey has quietly transformed into a hypercasual factory, Vietnam has built a thriving ecosystem of indie-to-midcore studios, and China towers above all with industrial-scale gaming giants exporting cultural influence worldwide.

And then there is India—a nation with the world’s second-largest gaming population, estimated at over 500 million players, but generating barely a fraction of global revenues. Mobile-first adoption, cheap data, and a young, digital-native population make India look like an obvious future powerhouse. Yet despite the size of its player base, the country’s share of global gaming exports and original IP success stories remains negligible. The paradox is striking: Is India destined to remain a sleeping giant of gaming—or is it on the cusp of an explosive leap into the global top tier?

Gaming Market

The global gaming industry has entered its golden decade—an entertainment juggernaut valued at more than $200 billion, eclipsing film and music combined. From hypercasual mobile hits to immersive AAA blockbusters, games are no longer fringe leisure but a mainstream cultural force shaping how people interact, learn, and spend. Emerging markets have become especially critical: Turkey has quietly transformed into a hypercasual factory, Vietnam has built a thriving ecosystem of indie-to-midcore studios, and China towers above all with industrial-scale gaming giants exporting cultural influence worldwide.

And then there is India—a nation with the world’s second-largest gaming population, estimated at over 500 million players, but generating barely a fraction of global revenues. Mobile-first adoption, cheap data, and a young, digital-native population make India look like an obvious future powerhouse. Yet despite the size of its player base, the country’s share of global gaming exports and original IP success stories remains negligible. The paradox is striking: Is India destined to remain a sleeping giant of gaming—or is it on the cusp of an explosive leap into the global top tier?

India’s Current Position

To understand India’s place, it helps to map the global landscape. The mature markets—the United States, China, Japan, South Korea, and leading European hubs like the UK and Germany—have long cemented gaming as a core pillar of both entertainment and industry. Each of these markets boasts globally recognized studios, blockbuster IPs, and diversified genre strengths. From Call of Duty and Fortnite in the U.S. to Genshin Impact in China, Pokémon in Japan, or League of Legends in Korea, these ecosystems not only serve domestic audiences but also export culture, technology, and billions in revenue worldwide.

In contrast, the emerging wave of challengers—Vietnam, Turkey, Saudi Arabia—shows how fast new ecosystems can rise with the right combination of talent, capital, and government backing. Turkey has turned into a hypercasual powerhouse with Dream Games and Peak Games scaling globally. Vietnam blends outsourcing heritage with indie flair, producing mobile chart-toppers across music, puzzle, and action categories. Meanwhile, Saudi Arabia is deploying sovereign capital through Savvy Games Group to leapfrog into global relevance, acquiring stakes in publishers and building esports infrastructure.

India’s trajectory looks different. The real-money gaming (RMG) boom—fantasy sports, poker, rummy—initially attracted the lion’s share of investor attention. For several years, this skew diverted capital and talent away from IP creation, only for the category to face regulatory pushback and outright bans in several states. In parallel, the broader market was shaped by imported successes: PUBG Mobile and Free Fire became cultural phenomena until regulatory suspensions forced local clones and alternatives. Casual titles like Ludo King showed that Indian studios could build at scale, but such sparks have yet to ignite into globally recognized franchises.

India today sits at a crossroads—huge player base, fragmented studio success, and a history of capital misallocation. The foundations are visible, but the leap to becoming a true gaming powerhouse is still waiting for its catalyst.

What Does India Have?

India is not starting from scratch. The country has several foundational strengths that, if leveraged correctly, could catapult it into the global top tier of gaming economies:

- Massive Player Base: With over 500 million gamers, India has the world’s second-largest gaming population. Unlike markets where PC or console drive adoption, India’s growth is overwhelmingly mobile-first, creating low friction for entry and scale.

- Digital Infrastructure: The Jio-led data revolution has made India one of the cheapest countries in the world for mobile internet. Combined with 5G rollouts and affordable smartphones, the technical barrier to gaming is lower than in many emerging markets.

- Youth Demographics: A median age of 28 and a digital-native generation spending hours daily on mobile devices means gaming is culturally primed for growth.

- Early Sparks of IP Creation: Games like Ludo King showed that local studios can achieve both domestic scale and longevity. Even if not global hits yet, they validate appetite for Indian-built experiences.

- Capital at the Gate: Venture funds and strategic investors are still circling the sector, particularly as RMG shrinks. The appetite is shifting toward casual, mid-core, and gaming-adjacent tech like streaming and esports.

Together, these elements give India the scale and raw ingredients that few countries outside China or the U.S. can match.

What Is India Missing?

Despite the promise, India remains underweight in several critical areas:

- Design Depth: India has engineering strength, but game design education and storytelling depth are underdeveloped. Without cultural, narrative, and mechanics expertise, global stickiness is hard to achieve.

- Global IPs: Unlike Turkey (Dream Games, Peak Games) or Vietnam (Amanotes, Falcon Games), India has not yet produced a breakout IP that dominates global charts. Most local hits remain domestically bound.

- Studio Culture: India has a fragmented ecosystem with small indie efforts and a few mid-sized studios, but lacks the scaling DNA of AAA or mid-core developers. Much of the industry’s talent has historically gone into outsourcing or IT services.

- Funding Focus: For much of the last decade, capital was disproportionately funneled into RMG—a regulatory gray zone. This starved traditional gaming startups of the risk capital needed to prototype and fail forward.

- Policy Orientation: While China industrialized gaming as a national priority (with Tencent/NetEase as champions), Indian policy has been dominated by taxation and compliance debates, especially around gambling, rather than incentives for IP creation.

- Exports Mindset: Indian gaming studios have largely built for Indian players. By contrast, Turkey and Vietnam built with global distribution in mind from day one, often through partnerships with publishers and UA networks.

What Needs to Change?

For India to transform from volume market to value creator, three shifts are crucial:

- Policy Reorientation:

- Move beyond gambling debates to a creative industry lens.

- Tax breaks, incubators, and production grants (similar to what Canada and Finland did for gaming) could stimulate IP creation.

- Formal recognition of gaming as part of the digital economy is key.

2. Talent and Ecosystem Building:

- Establish dedicated game design schools, partnerships with global engines like Unity/Unreal, and mentorship programs.

- Incentivize returning diaspora talent who’ve worked in AAA studios abroad.

- Build stronger community hubs (accelerators, conferences, creator networks).

3. Capital With Patience:

- Encourage VC and strategic investors to back multi-year IP bets, not just quick monetization plays.

- Create blended models of funding (government + private) for early-stage studios.

- Support UA budgets so Indian studios can actually test and scale globally, like Turkey did.

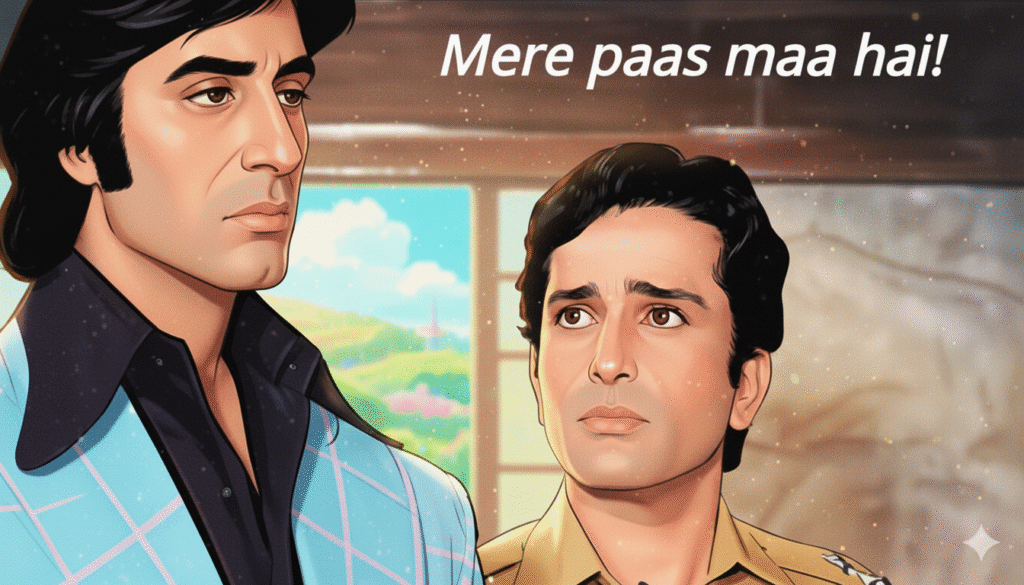

India’s mythology and pop culture are deep wells for storytelling. Turning Mahabharata, folklore, or Bollywood-scale narratives into interactive experiences could create globally resonant franchises, much as Japan and Korea leveraged anime and K-pop.

Is India Ready to Explode?

India’s gaming story is full of paradoxes. It has the world’s second-largest gamer base, but one of the lowest ARPUs. It has engineering talent in abundance, but limited global IP recognition. It has capital interest, but historically misallocated toward RMG. The result is a country brimming with potential yet still waiting for its breakout moment.

The next five years will decide whether India becomes a global gaming leader or continues as a market of missed chances. The ingredients—scale, talent, culture, infrastructure—are already here. What is missing is a catalytic push: policy that nurtures creativity, capital that takes risks, and studios that dare to build for the world.

When that first globally dominant IP emerges from India—whether a mid-core mobile hit, a culturally infused RPG, or a new multiplayer format—it will unlock not just billions in revenue but a redefinition of India’s global cultural influence. The question is no longer whether the opportunity exists—it’s who will seize it first.